Sustainability report 2023

The year in a nutshell

About the report

Kvika's sustainability report is published alongside the annual accounts of Kvika and its subsidiaries. The report presents the company's performance in matters relating to sustainability, i.e. environmental and social issues as well as corporate governance (hereafter "ESG").

The report follows Nasdaq‘s ESG Reporting Guide 2.0 and the latest version of the reporting standards of the Global Reporting Initiative (GRI 2021) were also used as a reference to a limited extent for certain disclosures. An index table is included at the end of the report with information on the ESG indicators that are covered in the report. Information is either displayed in the text of the report or in the index table.

The content of the report concerns the Kvika group (hereafter “Kvika” or “the Group”). The report covers Kvika´s Icelandic operations, i.e.Kvika banki hf. (hereafter “Kvika bank” or “the Bank”), which is the parent company of the group, and the subsidiaries TM tryggingar hf. (hereafter “TM”), Kvika Asset Management hf. (hereafter “Kvika Asset Management”), Straumur greiðslumiðlun ehf. (hereafter “Straumur”), Skilum ehf. (hereafter “Skilum”). Kvika bank’s brands include Auður, daughter of Kvika (hereafter “Auður”), Framtíðin, Netgíró, Aur app (hereafter “Aur”) and Lykill fjármögnun (hereafter “Lykill”).

Kvika´s activities through the British subsidiary Kvika Securities Ltd. (hereafter “Kvika Securities”) and Ortus Secured Finance Limited (hereafter “Ortus”), a subsidiary of Kvika Securities, are generally excluded from the coverage of the report, although information on the number of employees includes Kvika’s U.K. operations. The policies of Kvika Securities have to some extent been coordinated with Kvika’s policies in matters concerning sustainability but the collection of quantitative information, notably for environmental matters, has not yet been coordinated with other parts of the group.

CEO’s address

The year 2023 was an eventful one at Kvika and we are proud of the success we have achieved in the company's operations under conditions which were challenging in many areas. During the year major efforts were directed at continuing the implementation of the Sustainability Strategy adopted in 2022, with the involvement of Kvika employees, spanning all divisions and subsidiaries. As before, our goal is to make sustainability a part of our core business and decision-making.

In the long run, financial undertakings cannot operate except by doing so in a sustainable manner. It can therefore be said that financial activity and sustainability are actually two sides of the same coin. A good example of that is the success we achieved this year in further strengthening the bank's funding under Kvika's Green Financing Framework. In mid-November, we completed an offering of bonds denominated in SEK at more favourable terms than previously. We are proud of this first green bond issuance in SEK by an Icelandic bank.

Numerous exciting projects are currently underway with the aim of further increasing the sustainability of Kvika's operations, more details of which are provided in this report. Efforts have been made in many areas on climate-related product development, but a race has begun to achieve the Paris Agreement's emission reduction targets and it is clear that they will not be achieved unless institutional and private investors contribute and work together.

It is important that enterprises take part in green solutions through financing, and/or investment, to support Iceland’s progress towards carbon neutrality and that the projects undertaken are in addition operated profitably and sustainably. Here is where financial undertakings like Kvika will play a key role.

An audit by an independent external party has confirmed that in 2023 we improved the sustainability of our operations from the previous year. This is a recognition to our employees of the improvement work that has taken place at Kvika and the emphasis on sustainability in the Bank's operations. This is an incentive that will be reflected in our continued ambition to go further. The work is not finished, we are on a certain journey and want to achieve even greater results in the coming years which will result in increased value for shareholders, employees, the community and all other stakeholders in accordance with one of Kvika's guiding principles of being a responsible participant in society.

Reykjavík, 15 February 2024

Responsibility in action

Strategy and priorities

Since Kvika's founding, it has been our goal to increase competition, simplify customers' finances and thereby transform financial services in Iceland. We aim to achieve this through mutual benefit that serves the stakeholders of the bank, such as customers, shareholders, employees, and the community.

One of Kvika's strategic guiding lights is to be a responsible participant in society, thinking long-term and promoting a sustainable society through active participation. Kvika's strategy is presented below.

Structure of operations and services

Kvika bank is the parent company of the Kvika Group and consists of five business segments. Two of them operate as part of Kvika: Commercial Banking and Corporate Banking and Capital Markets. Three subsidiaries, TM Insurance, Kvika Asset Management and Kvika Securities, operate under their own brands. The bank's Board of Directors approved changes to its organizational structure at the end of 2022, which included transfers of projects and the introduction of new divisions. The new structure is intended to further encourage the bank's progress as a leading force in the financial market by increasing competition and innovation. The organizational changes took effect in the first half of 2023.

Structure of business segments

Commercial Banking

Kvika’s Commercial Banking divison provides investors, businesses and institutions with customized financial services and offers private customers a range of financial solutions via specialized brands and subsidiaries. These include Auður, which offers online savings accounts, Aur, which provides online financial services, Lykill, which specializes in asset leasing, Netgíró, providing payment services, Framtíðin, which offers supplementary housing mortgages and bridge financing, Skilum, which is a collection service, and Straumur, a new subsidiary of Kvika in payment services which began operation in the past year.

Corporate Banking and Capital Markets

Corporate Banking and Capital Markets provide a range of professional services in the fields of specialized financing, securities and foreign exchange transactions and corporate finance services.

Insurance

TM is a leader in digital insurance solutions and focuses on simplifying insurance matters for individuals and corporates. In October, the bank's Board made the strategic decision to begin preparations for the sale or listing of TM. Around mid-November it was announced that the sales process had begun and that Kvika would sell all outstanding shares in TM or sell part of its holding in the company to core investors, which could lead to its listing. The sales process is currently underway.

Asset Management

Kvika Asset Management provides a variety of asset management and investment services focused on good returns and clients’ long-term interests. Services offered by the company include private banking, fund management, private equity funds and asset management for institutional investors.

United Kingdom

Kvika Securities engages in diverse investment banking and asset management operations in the UK for Icelandic as well as foreign clients, as well as lending through the British company Ortus.

Organization chart

More information about Kvika's executive committee can be found on the company's website.

Sustainability in operations

In order to fulfill its role optimally, achieve set goals and work according to our guiding principle of being a responsible participant in society, Kvika has established a specific sustainability strategy. The strategy opens up opportunities for innovation and value creation. Thus, sustainability criteria are taken into account when developing and offering goods and services. During the year, various changes were undertaken in the operation and procedures altered to increase efficiency while reducing costs wherever possible. Changes were also made to Kvika's management team, as well as changes to the organization and procedures of committee work with the aim of improving decision-making. Responsible operations yield benefits to the company and all stakeholders, but profitable and responsible operation is a guiding principle in Kvika's operations.

New sustainability disclosure act

Finance plays a key role in achieving the EU Green Deal policy objectives, which include reducing greenhouse gas emissions by 55% by 2030 and achieving carbon neutrality by 20501, as well as international commitments to climate and sustainable development targets. Rapid developments have taken place in the EU regulatory framework, focusing on the necessary transitions, with the objective of channelling private investment and public funds to achieve a climate-neutral and environmentally sustainable economy. To that end, a comprehensive policy document has been developed by the EU and a plan for sustainable financing that aims to support the necessary changes.

In 2023 Act No. 25/2023 on sustainable financial disclosure and taxonomy for sustainable investments took effect in Iceland. The Act transposed the EU Sustainable Finance Disclosure Regulation (SFDR) and the regulation on the establishment of a framework to facilitate sustainable investment (EU Taxonomy) into Icelandic law.

The SFDR prescribes uniform rules for financial market participants and financial advisers on the information they are required to disclose appropriately to investors on the sustainability-related impacts of financial products.

The EU Taxonomy provides a harmonized framework that promotes sustainable investment. It establishes a classification system defining what constitutes sustainable economic activities. The system is intended to increase transparency by setting uniform criteria so that the disclosure of information by market participants and large companies can help investors and companies understand how sustainable certain economic activities are. In addition to enabling investors to make informed investment decisions aimed at sustainability, the framework is intended to create incentives for companies to implement a green transformation in their operations and to combat greenwashing. Kvika has been working on implementing the EU Taxonomy and will publish disclosures in accordance with the regulation for the financial year 2023.

Legislation has also been adopted at EU level on the dissemination of information on sustainability-related issues, such as environmental, social and governance issues, or the Corporate Sustainability Reporting Directive (CSRD). The objective of the CSRD, partly on the basis of the EU Taxonomy, is to provide a framework for requirements on companies regarding the content, presentation and consistency of sustainability information. This sharpens the transparency of sustainability information and contributes to investor safety in assessing investment options.

The CSRD enters into force in the EU at the beginning of 2024 and will subsequently be transposed into Icelandic legislation as required. Kvika‘s sustainability priorities has been implemented in stages in recent years alongside the growing importance of the field for the company, customers and other stakeholders of Kvika.

Kvika’s sustainability strategy

Kvika´s sustainability strategy was adopted in 2022 and lays the foundation for work within Kvika on ESG-related issues. The strategy has four main focus areas: sustainable business environment, product development and innovation, internal and external communications and employees and society. In parallel with the construction of the sustainability strategy, a materiality assessment was carried out on the main focus areas in regards to sustainability in Kvika's operations, resulting in the following key priorities that are still being pursued:

Governance

- Good governance

- Protection against money laundering, corruption, and bribery

- Information security and data privacy

- Development of digital services

Social topics

- Equality and well-being of employees

- Training and education of employees

Environmental topics

- Climate action in product development and innovation

- Climate action in the supply chain

Materiality assessment is an essential foundation for the implementation of the Group's sustainability strategy and projects. Discussion of materiality assessment has gained increased importance following the introduction of CSRD, which requires the implementation of double materiality assessment. Such a materiality assessment involves an analysis of which sustainability priorities are most important to the company, and its stakeholders, in two ways. On the one hand it is the impact of the company on the environment and society, and on the other hand on the impact of the environment and society on financially material factors within the company. Kvika will work on implementing CSRD in accordance with Icelandic legislation and update the materiality assessment on the basis of those changes.

Changes were made to the organizational structure of sustainability matters in 2023. Kvika operates a special sustainability committee which is now composed of the CEO and managing directors of subsidiaries and certain divisions as well as the Director of Sustainability. Changes in the composition of the Committee during the year were designed to increase its decision-making power. The area of sustainability was then transferred from the CEO's office to the Operations and Development division, which works across the entire group. Regular disclosure is also provided to the Bank's Board of Directors and sub-committees, but sustainability, non-financial disclosures and climate risk are regular items on the Board's agenda.

Education and increasing employees’ knowledge have a major role to play in the implementation of the sustainability strategy, in order to create an understanding of the content of the strategy and cultivate a culture related to it. The importance of sustainability has increased in decision-making and business development in line with increasing environmental and social challenges and growing customer interest in sustainability matters.Innovation in the development of products and services is therefore important to us as and can mitigate the impacts of climate change.

New sustainability risk policy framework

In 2023, Kvika adopted a sustainability risk policy framwork (hereafter “the Framework"). The Framework lays the foundation for managing sustainability risk within Kvika's divisions and its subsidiaries, and is based on Kvika's sustainability strategy, new regulations, and developments in the sustainability field in Iceland and abroad.

Sustainability risk has been defined as a special risk factor in Kvika’s activities and can be a risk driver for other types of risk, such as credit, market, operational and liquidity risk. Emphasis is placed on reducing sustainability risk, i.e. the risk that certain environmental, social or governance events or conditions could have a material negative financial or non-financial impact on the Group‘s operations, including on the value of investments, loans and insurance, as well as on Kvika's customers. Kvika follows a responsible product and service policy in developing new products and services, endeavoring to assess sustainability risks. To this end, a model has been developed which will facilitate access to information when assessing the sustainability risks of investments and loans.

Within the Framework, special consideration is given to climate risk, based on criteria of the Task Force on Climate-Related Financial Disclosures (TFCD). Climate risk is generally divided into two main categories, physical risk, arising directly from climate change, and transition risk, arising from actions to combat the effects of climate change. Physical risk can involve financial losses for Kvika, such as those following weather-related events which affect Kvika's investments or value chain. Transition risk can, for example, arise from the impact of rising energy prices or new regulations related to climate change prevention on the bank's investments.

Specific policies have been developed within Kvika Asset Management and TM concerning the inclusion of sustainability risk in investment decisions and investment advice, together with climate risk in insurance activities. Further information on these policies can be found in the sections on Kvika Asset Management and TM.

Strong infrastructure and value creation

Kvika Asset Managment

Continuous efforts are directed at better integrating sustainability into operations. This was among the guiding principles of the company’s strategic planning in 2023. Sustainability priorities were formulated, based on Kvika's sustainability strategy, as a part of the company's overall strategy. An ESG working group has been active in Kvika Asset Management, which has resulted in greater discussion and consolidation of projects in the field of sustainability across business units. During the past year preparation has taken place for the development of new ESG oriented funds to meet customer demand for investment options with ESG emphasis. Extensive work has also gone into implementing SFDR and EU Taxonomy.

Educating employees is an important part of the effective implementation of ESG factors in investment decisions and information sessions were held for employees on the EU legal framework regarding sustainability, with special focus on the most recent update of the Markets in Financial Instruments Directive (MiFID II). The changes provide investors with the opportunity to express their wishes for sustainability but increased disclosure on environmentally sustainable economic activities, together with increased transparency from financial market participants about their products and services, should enable investors’ sustainability wishes to be met. A workshop was also held in October 2023 aimed at increasing discussion and knowledge regarding responsible investment methodologies and the management of sustainability risks.

Sustainability risk policy

Kvika Asset Management’s new sustainability risk policy was approved in 2023, which describes how Kvika Asset Management integrates sustainability risk into investment decisions and investment advice. The policy builds on SFDR’s definition of sustainability risk and takes into accounts Kvika Asset Management’s sustainability policy, together with Kvika Asset Management's policy on responsible investments and Kvika's sustainability risk policy framework. The policy identifies the main risk factors included under sustainability risk, which are environmental and social factors, as well as the governance of the investee companies.

Kvika Asset Management’s private equity and venture capital funds

Kvika Asset Management’s first private equity fund was established in 2008 and today there are four private equity and venture capital funds which have provided almost ISK 25 billion investment in 25 companies. These funds are Auður I, Edda, Freyja and Iðunn.

These private equity and venture capital funds are strategic investors, that focus on proactively supporting management teams in improving operations and performance of the companies with emphasis on long-term returns and sustainability. Kvika Asset Management encourages investee companies to demonstrate social responsibility, adhere to good business practices and corporate governance, ensure diversity on boards and consider environmental issues.

In order to increase the knowledge of investee companies on sustainability issues, a sustainability workshop was held in January 2023 with experts from Lab21st. CEOs, CFOs and sustainability representatives of eleven companies owned by the funds participated in the workshop. Opportunities related to sustainability and the circular economy were reviewed, as well as changes in legislation concerning sustainability and corporate disclosure.

A special sustainability report for investors is issued annually for Kvika Asset Management’s private equity and venture capital funds which, among other things, assesses their performance based on specific ESG criteria. It is pleasing to report that over 80% of the companies have taken actions to increase employee well-being and over 60% measure their carbon footprint. Over 70% have implemented an equal pay policy and 45% of the companies have female CEOs. The 2022 report was the third sustainability report released by the funds to investors.

ESG-risk assessment

Working in the long-term interests of customers is a guiding principle for Kvika Asset Management. This means, among other things, that issues related to the ESG efforts of the companies invested in are considered. In line with the new sustainability risk policy as well as the company's policy on responsible investments, an industry-based ESG risk assessment, also called the sustainability risk assessment, has been further developed during the year.

That work took into account new regulatory requirements and updated methodology. The ESG risk assessment was prepared for the purpose of assessing the sustainability risk of Kvika Asset Management’s domestic portfolio. Its scope has included Icelandic issuers of listed and unlisted securities, excluding municipalities, states and fund managers. In 2023, work was done to expand the scope of the ESG risk assessment so that it can now be applied to lending activities by taking into account industry-specific risk factors. Various different factors are considered in carrying out risk assessments, which vary between asset classes and investment teams. The emphasis on ESG can apply to the entire investment process, i.e. from the examination of investment options, through due diligence and throughout the holding period.

TM

TM has for many years had sustainability at the forefront and is working to deepen the adoption of ESG elements in the company's operations. The implementation of sustainability affects all the main aspects of TM's activities, i.e. in its own operations, in investments and insurance. During the year, increased emphasis was placed on employees' knowledge of ESG aspects of TM's operations and to this end a presentation on sustainability priorities was held for management. A similar presentation is planned for TM employees in the first half of 2024. The main ESG aspects in TM's operations can be seen below.

Own operations

- Environmental issues in own operations

- Equality

- Governance

- Business conduct

Investments

- Responsible investments

- Green bonds

- PCAF assessment for financed emissions

Insurance

- Selecting business based on ESG criteria

- Green products

- Responsible treatment of claim waste

- Risk assessment for new customers applicable to enterprises with >50 employees

Sustainability risk management at TM

TM´s sustainability risk policy was formulated during the year as part of the Group's Sustainability Risk Framework. The strategy consists of three sub-policies described below.

Policy on Responsible Investments

The objective of TM's responsible investment policy is to integrate sustainability, or ESG factors, into existing processes when making investment decisions. Implementation of the policy involves, among other things, taking ESG factors into account when analyzing investment options, being an active owner when appropriate and taking ESG factors into account, and requesting information on ESG factors from stakeholders when appropriate.

Policy on Responsible Products and Services

Responsible provision of products and services means taking ESG factors into account when launching a new product or service and in its further development. Implementation of the policy involves, among other things, requesting information on ESG factors as appropriate, taking other policies related to sustainability into account, and reporting on the success of the policy's implementation.

Policy on Sustainability in Claims Services and Prevention

Responsible claims services means that ESG factors are taken into account when processing claims waste. Among the objectives of the policy is to limit the carbon footprint of claims and encourage the recovery of claims waste, wherever possible, to become part of the circular economy through reuse, repair or recycling. Appropriate clauses are also included in contracts with service providers in claims processing, increasing awareness of employees, customers and other stakeholders, and active disclosure.

Work has begun at TM on assessing climate risk as part of the company's risk management. However, it should be noted that the majority of claims attributable to natural disasters caused by climate change are the responsibility of the Natural Catastrophe Insurance of Iceland and are therefore not a major part of risk management in the company's operations. Climate risk assessment was for the first-time part of TM's Own Risk and Solvency Assessment, or ORSA, for the year 2022, which, among other things, assesses risks due to climate change and conducts scenario analyses related to the risks. The results of the assessment are documented in the company's ORSA report. TM assesses climate risk based on two main categories of such risk: physical risk and transition risk.

Development in TM's responsible investments

Extensive work has taken place within TM to measure the environmental impact of the company's investments, but responsible investments are the main pillar of TM's ESG policy as well as the company's sustainability risk policy. ESG risk assessments have been implemented for all new investments under the sustainability risk policy. Work was undertaken during the year on the classification of TM's non-life insurance according to the EU Taxonomy. In insurance activities, most non-life insurance is covered by the scope of the regulation (also known as taxonomy eligible). Life insurance and liability insurance, however, are not. TM interprets the regulation to cover those insurance products that do not exclude risks arising from events related to climate change, liability for such events is not excluded from the company's terms. The EU Taxonomy therefore covers the following categories of insurance:

- Property insurance

- Marine, air and cargo insurance

- Vehicle insurance

- Accident insurance

In the first year of implementation, 92% of non-life insurance premiums were aligned with the EU Taxonomy. To achieve this, the insurance must meet the special technical criteria set out in the regulation. TM discloses information according article 8 of the EU Taxonomy, which can be found in an appendix to the company's annual financial statement for 2023.

Sustainability in prevention and claims processing

Emphasis on sustainability in its insurance services, prevention and product line were a prime focus at TM in 2023 and included, among other things, the implementation of ESG priorities when renewing contracts with workshops and service providers handling claims concerning damage to property and vehicles. Work is also underway on implementing a new system for property damage, which gives more options for managing claims processing to include consideration of the reuse of damaged property or its disposal.

At TM, damage items have been re-used for years. A separate recycling space is operated where damage items are stored, and new uses are found for them. Special provisions have been included in policies on responsible disposal of damaged property, which provide for recycling, classification, re-use and disposal.

TM has supported the implementation of technical equipment from Hefring Marine, which measures, among other things, impacts that passengers experience when travelling in inflatable (RIB) passenger boats. This has contributed to the prevention and reduction of accidents involving TM's customers, who, among other things, benefit from lower premiums.

TM was a participant in a working group of Finance Iceland (SFF) on the creation of a new version of a climate guide for the sector. The group's conclusion was to focus on reducing claims through prevention measures and on reducing the carbon footprint of claims processing by encouraging claims to flow into the circular economy to the extent possible through reuse, repair or recycling.

As a result, special emphasis was placed on the following aspects:

- Increasing preventive measures against claims

- Increasing availability of used vehicle parts domestically

- Strengthening customer education

TM's membership to the Principles for Sustainable Insurance (PSI)

TM became a member of the global sustainability framework for insurance companies, Principles for Sustainable Insurance (PSI), at the beginning of 2023. PSI is a collaborative initiative between the United Nations and insurance companies for the management of environmental, social and governance risks as well as the utilization of opportunities.

With its membership, TM has committed to work according to the PSI criteria, which are:

- Implementation of ESG factors in the company's operations.

- Collaborate with customers and partners on raising awareness of sustainability issues with an emphasis on risk management of ESG factors and development of appropriate solutions.

- Collaboration with governments and other key stakeholders to raise awareness of ESG issues.

- Regular reporting on the progress in implementing the criteria.

By joining PSI, TM has access to a variety of educational materials for employees that are useful for training and raising awareness of ESG issues. The company's first report on the progress of implementing PSI’s criteria was submitted to the organization at the end of 2023.

Fintech and innovation

Our goal is to increase competition, simplify customer finances and by doing do transform financial services in Iceland. A report published this year by a working group of the Minister of Culture and Trade describes the improved situation of consumers in various areas of banking services in recent years. Increased competition in the deposit market with the introduction of Auður's savings accounts was mentioned specifically in that context. Auður has made strong progress since it appeared on the scene and has over 40,000 users but in 2023, Auður ranked highest of 145 companies in Maskina's recommendation survey.

We focus on innovation in product development and services and on developing digital solutions, which provide both social and environmental benefits such as time savings for customers, less paper and fewer car trips. New solutions have been launched in Kvika's product range and customer services this past year, including the establishment of Straumur, the issuance of Aur’s electronic payment cards and increased digital financial services.

Along with emphasizing innovation in product development, there is great ambition within the Group’s brands to do good with the help of fintech solutions, and among other things, many organizations have been supported through Aur’s services by waiving fees or acquiring fees. These organizations use Aur to enable people to support their activities, either directly or through the sale of goods.

In line with the Group's digital journey, almost all loans and deposits are electric, with the proportion of electronically established loans during the year being 99.9% and the proportion of electronically established deposits being 98.1%. Many of Kvika's brands are fully digital or take advantage of opportunities to automate processes. These include major changes that have taken place in the process of financing motor vehicles and machinery at Lykill, for both individuals and legal entities. Today, almost all loans and contracts are approved online, to the benefit of everyone involved in the process, including Lykill’s customers, partners and district commissioners throughout the country. Thanks to Lykill’s strong emphasis on automation, customers can now approve requests for information, perform credit checks, sign bonds and contracts, carry out ownership changes and sign all documents online.

Society

Our people

Kvika's employees are of key importance, because their knowledge and skills have brought the company to where it is today. At year-end 2023, the Group had 374 employees, compared to 386 at year-end 2022. This includes operations in the UK. During the year, the integration of operations in Iceland continued after they had merged under one roof in the summer of 2022, with efforts directed at having employees get to know one another and the operations of the different units within the group.

Employee well-being

At Kvika, we strive to create a positive and secure work environment where everyone has equal opportunities. Policies have been adopted on human resources and equality, as well as policies on health, education and career development and remote work. A policy on retirement was also introduced which emphasizes approaching retirement due to age with respect and flexibility as a guiding principle.

Good health is a prerequisite for success at work as well as in other areas of life. To promote better health and well-being of employees, fitness and transportation grants are provided, and employees are invited to undergo annual vaccinations and health checks at the workplace. Health weeks have also been held, during which educational talks and various types of exercise are offered and staff are encouraged to pay attention to their health.

Employees are also offered fitness classes at lunchtime twice a week at the company's expense, as well as occasional short yoga classes in the workplace. In addition, a healthy and nutritious breakfast and lunch is offered daily, and healthy snacks are available to all employees.

Education

Numerous courses and other training are available to employees, both optional and compulsory, aimed at adding to their knowledge of the operations and enhancing their skills. In most cases,the dissemination of the material takes place through a digital education system that also keeps track of employee participation. Shorter courses and talks are also held on Kvika's premises. On average, each employee of Kvika attended 40 digital courses in 2023, 35 compulsory courses and 5 optional courses.

Sustainability education was provided in a variety of ways, including special presentations on sustainability reports as well as regular micro-courses on specific topics in the field of sustainability. Other courses included optional courses on pension matters. These were designed both for employees nearing retirement age and also for all employees. In addition, a special course was offered for summer employees and younger staff on finances of young people, first home purchases and the like.

During the year, a number of employees of Kvika, Kvika Asset Management and TM attended courses on responsible investments organised by UN PRI. The courses cover, among other things, the principles of UN PRI, responsible investment methodologies, opportunities and risks in applying ESG factors in the analysis of investment options. Staff education on ESG issues is one of the main prerequisites for success in the implementation of ESG factors in investment decisions.

Remuneration and metrics

Kvika’s remuneration policy is implemented systematically and salary analyses are regularly carried out to monitor wage developments in the market, in order to ensure that the company offers competitive salaries reflecting the scope, responsibility and performance of the work. Sustainability risk has been implemented in the company's remuneration policy and is taken into account in the performance criteria of the bonus system.

Kvika hf., TM and Kvika Asset Management all have equal pay certification and satisfy the requirements of the standard ÍST 85:2012. The gender pay gap is measured quarterly within all companies to effectively monitor the gender pay gap. Dissemination of information to management on salary development, as well as other indicators used regarding human resources, has been strengthened. With the increased use of the Power BI software for analyzing and utilizing data, indicators such as employee turnover, sickness absence and participation in education are monitored.

Opinion survey

In order to obtain the best picture of employees’ well-being and attitudes towards their workplace, their job and management, an opinion survey is carried out annually, which examines, among other things, dedication to work, job satisfaction, stress, attitudes towards equality matters and work-life balance. It also includes questions on work-related bullying, harassment or violence. Following such surveys, the results are scrutinized, and an action plan is set up as appropriate.

The 2023 survey showed that job satisfaction is high and dedication has strengthened year by year.

The survey also revealed that staff morale is high and co-operation among them is good and that employees are proud to work for the company. The opinion survey also points out opportunities for improvement and gives a greater understanding of how we can build a supportive and encouraging work environment. The analysis also gives us insight into the differences in employee attitudes or experiences between different units.

UN Sustainable Development Goals

Kvika supports the United Nations' Sustainable Development Goals (SDGs) and emphasizes six goals that best fit Kvika's sustainability policy and operational focus but they are goal 3 on good health and well-being, goal 4 on quality education, goal 5 on gender equality, goal 9 on industry, innovation and infrastructure, goal 13 on climate action and goal 17 on partnerships for the goals. The SDGs have been integrated into Kvika's policy on grants, but according to the policy the SDGs shall be taken into account, together with other priorities of the bank's sustainability policy, when selecting projects.

Kvika provides a variety of grants that have a positive social impact, the total amount of which amounted to ISK 87 million in 2023. An example of grants awarded during the year is a grant of ISK 7,5 million from Kvika's Incentive Fund, which was awarded to ten vocational students and six teacher trainees. The goal of Kvika’s Incentive Fund is to promote discussion and awareness of the importance of vocational studies and teaching studies and their importance for the Icelandic economy. but there is a shortage of vocational workers and teaching staff. Grants from the Incentive Fund are related to SDG 4 on quality education.

On Icelandic Women's Rights Day on June 19, grants were awarded from the fund FrumkvödlaAuður, the goal of which is to encourage young women to show initiative and take action. In the year 2023, the fund received 50 applications for grants and five projects were awarded funding. This was the 14th time the fund has issued grants.

The overview below demonstrates how the six SDGs fit into Kvika's sustainability strategy.

Environmental and climate issues

Kvika can have the greatest impact on environmental and climate issues through lending and investments. We support the Icelandic government's target of achieving carbon neutrality by 2040, and now assess, among other things, greenhouse gas emissions related to the company's investments and loans. There was a substantial increase in Kvika's green commitments in 2023, as explained in more detail in the company's allocation and impact report, which can be found in this section.

Specific efforts are also directed at limiting the environmental impact of our own activities and reducing them as best we can, see Kvika's environmental and transport policy. The data is managed in a digital environmental management system in collaboration with Klappir Grænar Lausnir hf. The environmental accounting has been audited and attested to by a certified auditor with limited assurance. In recent years, activities have undergone considerable changes with the acquisition of companies and the consolidation of operations at a single location. The overview below shows the main environmental indicators compared to previous years. The increase in most of the indicators is explained to a large extent by increased activity.

Management of environmental risk, as part of sustainability risk, is a major factor in the implementation of the new EU regulations on sustainability disclosures. There is ongoing work, within units of Kvika, on formulating quantitative environmental targets and action plans, but to date measurable targets have yet to be set.

Implementation of the EU Taxonomy

Kvika has been working on implementing the EU Taxonomy, but the objective of the regulation is, among other things, to increase transparency and direct funding towards environmentally sustainable investments. Kvika is required to publish the proportion of assets that finance economic activities covered by the regulation. This includes lending and financing to large companies in accordance with the Act on Annual Accounts, loans and financing to individuals, i.e. car loans and mortgages, as well as investments in companies that are in scope as defined in the Act on Annual Accounts.

In order to enforce the provisions of the EU Taxonomy, an analysis was carried out on which assets meet the technical criteria set out in the delegated acts and the green asset ratio (GAR) calculated. The green asset ratio is the proportion of the Group’s assets financing or invested in economic activities that are taxonomy aligned (also known as environmentally sustainable) to the total volume of assets.

The Group’s green asset ratio according to the EU Taxonomy at the end of 2023 is 0%. This is mainly because, according to the Act on Annual Accounts, companies publishing according to Article 8 of the regulation will not publish information in accordance with the regulation until early 2024 and therefore information is not available on whether the activities of the companies in which the assets lie at the end of 2023 are environmentally sustainable. Loans and financing to individuals do not meet the requirements of the technical criteria of the delegated acts of the EU Taxonomy and therefore do not comply with the EU Taxonomy in the first year of implementation.

Kvika publishes information according to Article 8 of the EU Taxonomy according to templates provided in the delegated regulation (10/2024) annexed to Kvika’s annual financial statement.

Environmental indicators

The tables below show the key environmental indicators for 2023 and year-on-year trends. Following the consolidation of the operations of the Icelandic units of the Kvika in 2022 at Katrínartún 2, activities have increased and this increase is visible in the key environmental indicators.

Most of the Group’s emissions are in scope 3, which in 2023 was 434.3 tonnes CO2. Scope 3 includes transportation and business travel by staff as well as operational waste. The largest portion of emissions come from transport and business travel and the increase in Scope 3 from the previous year can be attributed, among other things, to an increase in air travel, but fewer trips were made in 2021 and 2022 during the pandemic.

Efforts are being made to gain a better overview of waste generation and improve waste measurement, with the focus on automation of the relevant processes. Good results have been achieved in sorting waste this year. The reported Scope 3 does not cover emissions from the Kvika's loan and investment portfolio nor the disposal of claims waste from insurance activities, but further discussion of responsible claims disposal can be found in the chapter on TM.

Emissions during the year and carbon offsetting

We work to reduce greenhouse gas emissions from our own operations and look for ways to tackle climate change in the value chain through supplier selection as well as in investments and lending. Kvika's total greenhouse gas emissions, Scope 1, 2 and 3, in 2023 amounted to 535 tonnes CO2.

Through partnership with Climate Impact Partners specialist in carbon market solutions for climate action, scope 1-3 greenhouse gas emissions linked to the Kvika's normal operations have been offset through the acquisition of high-quality carbon credits. These credits are helping to deliver finance to emission reduction projects around the world, supporting the transition to a low-carbon global economy. All the projects are independently verified to ensure emissions reductions are occurring.

We are specifically focused on supporting nature-based projects, which remove carbon from the atmosphere by planting woodlands and forests, and restoring grasslands. Each project in the portfolio we have purchased from also delivers a suite of co-benefits, ranging from biodiversity conservation to local job creation, which align with the United Nations Sustainable Development Goals.

More information about the projects can be found on the Climate Impact Partners.

The carbon credits purchased offset the emissions that are unavoidable in the Group's operations, but emissions from, among other things, the Group's loan and asset portfolio are not included as part of our carbon offsetting program.

Carbon credits for the future

At the end of 2023, Kvika purchased carbon credits from Yggdrasill Carbon, which are credits that have not matured (ex ante). Yggdrasill's projects are designed with a 50-year vision and arise from a new forestry project at Arnaldsstaðir. More information can be found on the Yggdrasils Carbon website. The carbon units that Kvika has purchased are certified according to the requirements of the Skógarkolefni project of the Icelandic Forest Service.

Financed emissions

In 2022, Kvika became a member of the Partnership for Carbon Accounting Financials (PCAF), which is an international collaborative project of financial undertakings working together to develop and implement a harmonized approach to evaluating and reporting the greenhouse gas emissions that they finance with loans and investments. Kvika has now for the second time calculated its financed emissions of greenhouse gases using the PCAF methodology and plans to publish a separate report with these findings in 2024.

Green financing framework

Financial undertakings have an important role to play in directing funds to projects that have a positive impact on the environment and curb climate impacts, as well as meeting growing customer demands for investment options that contribute to increased sustainability.

Kvika's green financing framework outlines how funds are allocated to green projects. Green projects include lending related to energy transition in transportation, environmentally certified buildings, and renewable energy. The green financing framework builds on international principles (Green Bond Principles) that were issued by the International Capital Market Association (ICMA). The framework received a positive second opinion from the international assessment and analysis company Sustainalytics, which stated that the framework is credible and has all the potential to be effective.

The criteria of the Green Bond Principles used in Kvika's green financing framework are:

- Use of Proceeds

- Process for Projects Evaluation and Selection

- Management of Proceeds

- Reporting

Kvika’s sustainability policy and the Bank’s policy on responsible lending and investment, which is annexed to its credit rules, set out emphasis within green and sustainable lending. Internal economic incentives have been set for the bank's business units which give green projects more favourable internal pricing. This encourages the revenue divisions to invest in green projects and increase the share of green lending which also contributes to green investments. The quarterly confirmation of green assets as provided for in Kvika's green financing framework is in the hands of the bank's Credit Committee.

Kvika has issued three bond classes under its Green Financing Framework, two in ISK and one in SEK. The latter was issued at the end of 2023 and it was the first green bond issued by an Icelandic bank in SEK. There has been good growth in Kvika's green assets, which is reflected in the company's green financing capacity and this growth is expected to continue as the knowledge of the loan divisions increases and loan books expand.

Allocation and impact report

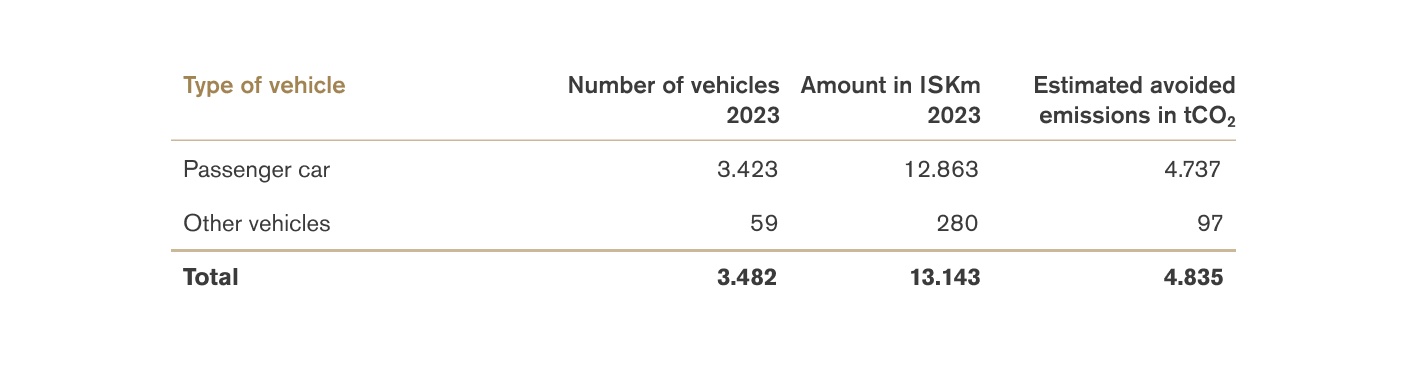

Kvika reports on the progress of its green commitments annually in its allocation and impact report, published as part of the Kvika's sustainability report. The total balance of green commitments at year-end 2023 amounted to ISK 13,320,150,648 which includes the total of green bonds issued plus deposits on Auður's green future deposit accounts. Green commitments increased by 108.36% during the past year.

All green liabilities have been allocated within the asset class “clean transportation” for vehicle loans for the purchase of all-electric or plug-in hybrid cars by Lykill. In doing so, Kvika creates incentives to reduce greenhouse gas emissions and supports customers' sustainability journey.

Green products

Lykill’s green loans

Lykill offers favourable loans for the purchase of cars that run on renewable energy. These include electric and hydrogen cars that run on 100% renewable energy and plug-in hybrid cars with an emission factor below 50g CO2/km in accordance with Kvika's green financing framework.

Auður’s green future deposit accounts

Green future deposit accounts are accounts for young people who care about the environment and want to guarantee a good return on their savings. The accounts are inflation-indexed and offer favourable interest rates. In 2023, family members were given joint access to information about the position of green future deposit accounts.

Kvika's environmentally friendly vehicle financing that is included in the green financing framework includes passenger cars, vans, trucks, motorcycles and heavy commercial vehicles. The largest category is passenger cars.

To put the estimated avoided emissions in context, it is the equivalent of the emissions of:

Governance and ethics

The management of Kvika bank, which is the Group's parent company and a listed company on the Nasdaq Iceland stock market, believes that good governance is a prerequisite for responsible operations and trust in the company for the benefit of all stakeholders. The framework for Kvika's governance is based on the company's articles of association, policies and instructions approved by the Board of Directors and the guidelines on corporate governance issued by the Iceland Chamber of Commerce, the Confederation of Icelandic Enterprise and Nasdaq Iceland. The company also follows the guidelines of the European Banking Authority (EBA/GL/2021/05) on internal governance of financial institutions.

Kvika bank and TM continue to be recognized for their high-quality corporate governance by the Iceland Chamber of Commerce, the Confederation of Icelandic Employers, Nasdaq Iceland and Excellence Iceland. The award applauds the well-organized governance exercised by the companies’ Boards of Directors and endorses them as models to be followed. The recognition is based on an assessment of Kvika's and TM's corporate governance based on the guidelines and co-ordinated by Excellence Iceland.

Information on key aspects of corporate governance is provided in the annual report of the Board of Directors and the corporate governance statement that is published with the annual financial statements and on Kvika's website, in accordance with the relevant requirements. Although Kvika's operations are partly carried out through its subsidiaries, as the parent company Kvika bank is responsible for the Group's corporate governance and has adopted ownership policies for the bank's important subsidiaries. The corporate governance statement includes information on the main aspects of internal control, risk management and reporting by Kvika bank. Information about the bank's Board of Directors is provided in the corporate governance statement and on the bank's website.

The entry into force of Act No. 25/2023 on sustainable financial disclosure and taxonomy for sustainable investment, has far-reaching implications for the Bank's operations and affects many internal rules, policies, procedures and processes. Extensive work has been undertaken in this area, but work will continue in line with new legislation until the implementation is fully complete.

Measures against financial crime

In March 2023, the Board of Directors of Kvika approved for the first time a comprehensive group policy on measures against financial crime.The policy aims at co-ordinating actions against financial crimes across the Group and the bank's subsidiaries are expected to implement the policy in their operations with appropriate internal rules, processes and procedures.

The aim of the policy is to prevent the Kvika’s activities from being used for any kind of financial and enrichment offenses. The policy is intended to ensure adequate control and monitoring of identified risk factors in the Kvika’s activities so that risks can be effectively managed and mitigated.

The policy aims to define the framework that Kvika’s Board has set and expects to be followed in the Kvika’s everyday operations regarding actions to prevent financial crime, in accordance with relevant legislation at any given time. It is the responsibility of the respective units within each company to elaborate the policy with more detailed procedures and processes with respect to, and consistent with, each company's activities and scope, to ensure full compliance with the policy.

The policy lays out, among other things, the responsibility of management and staff for measures against financial crime, the risk appetite of the parent company's Board and attitudes towards the following issues:

- Money laundering and terrorist financing

- Economic sanctions

- Tax evasion

- Bribery and corruption

- Market abuse

Employees are required to notify the compliance division immediately of transactions or movements where there is suspicion that they could be attributable to financial crimes or other criminal conduct. The bank's internal rules on reporting procedures must be followed when employees report violations of the law or reprehensible behaviour.

Within Kvika, continuous efforts are directed at strengthening the bank's defences against money laundering and terrorist financing. The bank's risk assessment and methodology are regularly reviewed, as is its data quality in connection with the classification of investors, increased knowledge of the field and regular monitoring practiced in the first line of defence.

Compliance policy

Kvika's new compliance policy was approved by the Board in February 2023. The policy applies to all activities, employees and directors, and the boards of regulated subsidiaries are required to discuss the policy and ensure that its requirements are implemented in their day-to-day operations.

The policy is intended to ensure that all operations within Kvika comply with laws, rules, recommendations, and guidelines that apply to operations at any given time. Furthermore, it aims to clarify the role of and responsibility for compliance within the Group and to ensure that adequate supervision is always in place. The policy also deals with the existence and role of an independent supervisory unit, Compliance, which is to monitor compliance risk and support Kvika's employees who are responsible for compliance in their daily work.

The policy defines the Board's risk appetite for compliance risk and states that:

“The Board of Directors desires and requires that the Group's activities always comply with current laws and regulations, and that compliance and the management of compliance risk be an integral part of every type of business and procedure.”

Enormously complex and extensive legal requirements apply to the activities of financial undertakings, issuers of financial instruments, fund management companies, insurance companies and payment service providers. Projects related to the implementation of new and pending legislation have been very extensive recently and will continue for the foreseeable future. These projects are always given highest priority within the company, and the Board and management attach great importance to constantly working on and maintaining a culture and attitude that encourage compliance with the requirements made of Kvika bank and the Group.

Kvika’s code of conduct

In February 2023, Kvika's Board of Directors approved a new employee code of conduct. The code of conduct is set on a consolidated basis and is incorporated unchanged into the rule books of subsidiaries. A single, common code emphasizes that the Group has co-ordinated criteria for good business practices and employees must use the rules as a guide in their dealings with customers and others in the course of their work. Employees confirm their compliance with the Code annually. Kvika's code of conduc is intended to ensure the security and interests of Kvika's customers and other stakeholders in their dealings with and in their work for the Group. Furthermore, the Code is aimed at ensuring a good working environment and encouraging good working practices. The rules are also intended to mitigate risks, in particular operational and reputational risks, which may have adverse effects on the Group.

Among other things, the Code clearly states the responsibilities of employees in their work, ongoing confidentiality and appropriate handling of information, communication with customers, handling of conflicts of interest, requirements for professional services and work procedures, compliance with laws and regulations, risk management and attitudes towards sustainability. Kvika’s code of ethics for suppliers, which was established on the basis of the company’s sustainability policy, lays down the ESG criteria that suppliers and service providers must follow.

Information security

Emphasis is placed on ensuring that all processing of personal information is in accordance with the provisions of the Act on Personal Data Protection and in 2023 Kvika approved an updated personal data protection policy, prescribing details of what personal data Kvika gathers on customers, how the bank processes personal data and for what purpose, how long the information can be expected to be preserved, to whom it can be communicated and how its security is ensured in the bank's operations.

Kvika has an information security management system which is certified according to the ISO/IEC 27001 standard and an appropriate information security policy. The security management system ensures systematic work practices and processes in handling important information and systems. Kvika's aim is to ensure the responsible handling of the information that customers have entrusted to Kvika, and to protect this, together with sensitive data related to Kvika's operations, from unauthorized parties.

The system supports Kvika's information security policy, whose objectives are, among other things:

- Minimize operational risk

- To prevent conflicts of interest

- Increase the service level of information systems

- Increase the reliability and operational security of information systems

At Kvika, systematic risk assessment is carried out to determine whether further measures are needed regarding specific data or information systems, and the information security policy is reviewed at least every two years.

Index table

About the company

| Description | Chapter/material | Page | GRI indicators for reference |

|---|---|---|---|

Name of organization | Kvika banki hf. | - | GRI 2-1 (a) |

Nature of ownership and legal form | Publicly listed company | - | GRI 2-1 (b) |

Location of headquarters | Katrínartún 2, 105 Reykjavík | - | GRI 2-1 (c) |

Countries of operation | Iceland and the UK | - | GRI 2-1 (d) |

Entities included in the report | Chapter: About the report | 2 | GRI 2-2 |

Reporting period for sustainability reporting and frequency | 1 January – 31 December 2023, yearly | - | GRI 2-3 (a) |

Reporting period for financial reporting | 1 January – 31 December 2023 | - | GRI 2-3 (b) |

Publication date of report | 15 February 2024 | - | GRI 2-3 (c) |

Contact point for questions regarding the report | Helena Guðjónsdóttir, thjonusta@kvika.is, tel. +354 540 3200 | - | GRI 2-3 (d) |

Information on employees | Chapter: Our people | 16 | GRI 2-7 GRI 2-8 |

Environment (E)

Greenhouse Gas Emissions

Energy

Water Consumption

Waste

Environmental Operations

Climate Oversight

Social aspects (S)

Employee Turnover

Work Environment

Gender Diversity

Compensation

Temporary Worker Ratio

Non-discrimination

Governance (G)

Board Diversity

Board Independence

Incentivized Pay

Collective Bargaining

Supplier Code of Conduct

Ethics & Anti-Corruption

Sustainability Reporting

Independent Auditor’s Assurance Report

To the Management and the stakeholders of Kvika Banki hf.

We have been engaged by Kvika Banki hf. to provide limited assurance on non-financial information disclosed in ESG index table in Kvika Bank’s Sustainability report for the year 2023. The report is based on Nasdaq ESG Reporting Guide 2.0, with reference to certain GRI Standards indicators.

Our engagement was performed in order to:

- Assess whether ESG index table, on page 28-30 in Kvika Bank´s Sustainability report for the year 2023, is presented according to Nasdaq ESG Reporting Guide 2.0;

- Review underlying data processes;

- Assess whether overall text in the Sustainability report 2023 is in accordance with disclosed indicator;

- Allocation of net proceeds from Green Bonds are used to finance projects that meet the criteria of the Bank’s Green Financing Framework as shown on pages 23-24 in the Sustainability report for the year 2023.

We express a conclusion providing limited assurance.

Management’s responsibility

The Management of Kvika Bank is responsible for collecting, analysing, aggregating, and presenting the information in the report, ensuring that the information is free from material misstatement, whether due to fraud or error.

Our independence and quality control

We have complied with the independence and other ethical requirements of the Code of Ethics for Professional Accountants (IESBA Code), which are based on the fundamental principles of integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour.

Deloitte ehf. is subject to International Standard on Quality Management (ISQM) 1 and, accordingly, applies a comprehensive quality control system, including documented policies and procedures regarding compliance with ethical requirements, professional standards, and applicable legal and regulatory requirements.

Auditor’s responsibility

Our responsibility is to express a limited assurance conclusion on the ESG index table and allocation of net proceeds in Allocation and impact report for the year 2023, presented in the Sustainability report. We have conducted our work in accordance with ISAE 3000 (revised), Assurance Engagements Other than Audits or Reviews of Historical Financial Information, to obtain limited assurance about our conclusion. In accordance with the standard, we have planned and performed our work to obtain limited assurance about whether the ESG index table and Allocation and impact information is free from material misstatement.

A limited assurance engagement is less in scope than a reasonable assurance engagement. Consequently, the level of assurance obtained in a limited assurance engagement is lower than the assurance that would have been obtained had we performed a reasonable assurance engagement. Considering the risk of material misstatement, we planned and performed our work to obtain all information and explanations necessary to support our conclusion.

We performed reviews of data, recalculation of data, reviews of the underlying data processes as well as interviews with those responsible for producing the data. Our work has included interviews with key functions in Kvika Bank, inquiries regarding procedures and methods to ensure that selected indicators and non-financial information have been incorporated in accordance with the guidelines in Nasdaq ESG Reporting Guide 2.0. We have assessed processes, tools, systems, and controls for gathering, consolidating and aggregating non-financial data at Kvika Bank, and performed analytical review procedures and tested data prepared against underlying documentation. Furthermore, we have evaluated the overall presentation of Kvika Bank’s Sustainability Report for the year 2023, including the consistency of information.

Conclusion

Based on the procedures we have performed and the evidence we have obtained, nothing has come to our attention that causes us to believe that Kvika Bank’s ESG index table and the Allocation and impact report for the year ended 31.12.2023 is not prepared, in all material respects, in accordance with Nasdaq ESG Reporting Guide 2.0 and that the overall text in the Sustainability report is in accordance with disclosed indicators.

Kópavogur, 15 February 2024

Deloitte ehf.