Sustainability Report 2022

About the report

This is the second time that Kvika publishes a sustainability report regarding its operations. The report is published alongside the annual accounts of Kvika and its subsidiaries. The report is intended to provide a holistic view of the operations and achievements in the areas of sustainability with regards to environmental and social aspects, as well as providing information on governance (ESG).

The report follows the ESG Reporting Guide 2.0 of Nasdaq and the latest version of the reporting standards of the Global Reporting Initiative (GRI 2021) were also used as a reference to a limited extent for certain disclosures.

An index table is included at the end of the report with information on the ESG indicators that are covered in the report. Information is either displayed in the text of the report or in the index table.

The content of the report concerns the Kvika group (hereafter “Kvika”). The report covers Kvika´s Icelandic operations, i.e. Kvika banki hf. (hereafter “Kvika bank” or “the Bank”), which is the parent company of the group, and the subsidiaries TM tryggingar hf. (hereafter “TM”), Kvika Asset Management hf. (hereafter “Kvika Asset Management”), Straumur greiðslumiðlun ehf. (hereafter “Straumur”), Skilaráðgjöf ehf. (hereafter “Skilaráðgjöf”). Kvika bank’s brands include Auður, daughter of Kvika (hereafter “Auður”), Framtíðin, Netgíró, Aur app (hereafter “Aur”) and Lykill fjármögnun (hereafter “Lykill”).

Kvika´s activities through the British subsidiary Kvika Securities Ltd. (hereafter “Kvika Securities”) and Ortus Secured Finance Limited (hereafter “Ortus”), a subsidiary of Kvika Securities, are generally excluded from the coverage of the report (information on the number of employees, however, includes Kvika’s U.K. operations). The policies of Kvika Securities have to some extent been coordinated with Kvika’s policies in matters concerning sustainability but the collection of quantitative information, notably for environmental matters, has not yet been coordinated with other parts of the group.

CEO’s address

We at Kvika are proud of the results of 2022 as the core operations of the group delivered strong results in challenging market conditions. Part of these results can be allocated to dedicated action over the last few years in adding operational revenue streams as well as to the powerful people in our workforce. During the year Kvika bank received a credit rating of Baa2 from Moody’s which is a pleasant milestone that supports the continuous development of the Bank. The rating is an acknowledgement of Kvika bank as a trusted issuer of bonds and receiver of deposits.

During the year we took important steps in strategic planning with the participation of employees from all parts of the group. New projects were defined with the aim of increasing the sustainability of Kvika’s operations. Sustainability has now become part of our core business and decision making. A new sustainability strategy was approved this year and we put emphasis on defining where Kvika’s business units, as well as operations and risk management, can seize the opportunities inherent in society´s adaptation to the impact of climate change. The focus areas of the new strategy are innovation and product development, sustainable business environment, communication, employees, and society. We support the UN Sustainable Development Goals and have chosen six goals to pay particular attention to, the ones we believe best suite our activities and priorities in regards to sustainability.

Increased flexibility in remote work for employees, that was established during the corona virus pandemic, has been maintained in order to support the health and well-being of employees, and a new policy for remote work has been established. At the end of last year an opinion survey was conducted among employees and other stakeholders of Kvika concerning the topics that are considered most important in our work towards increased sustainability. A discussion of the survey can be found in this report, but the results will be useful for us to prioritize and form new sustainability projects where Kvika can have an impact.

Reykjavík, 15. February 2023

Responsibility in action

Strategy development and organization

Kvika’s strategy

Kvika’s strategy emphasizes sustainability in its operations. The strategy outlines a clear vision which is to transform financial services in Iceland with a mutual benefit as a guiding light. A benefit for customers and the society as well as stakeholders and employees. When embarking on a transformation journey it is necessary to include the necessary tools. We have done this at Kvika through our values which are simplicity, courage, and long-term thinking.

Fintech | increase the number of customers of fintech solutions that use three or more fintech services by 50,000. |

Sustainability | having a real and measurable impact on Iceland’s carbon footprint and climate issues in general. |

Kvika Securities Ltd. | UK operations will account for at least 20% of the Group´s profit. |

Asset management | grow asset management operations faster than the domestic market. |

Insurance | be Iceland´s most profitable insurance company and increase market share. |

Finance | funding costs will be comparable to those of Iceland's other banks. |

Return on equity | reach 20% return on tangible equity. |

Organizational changes

At the end of 2022 the board of Kvika bank approved changes to the organizational structure. The new organization has been adjusted to a growing company that focuses on being a leader in increasing competition and innovation in the financial market. The organizational changes include that part of the commercial banking division and corporate banking division will form a new revenue division called Companies and Markets [HG1] which will start operations in 2023.

The new revenue division will sharpen the distinction of Kvika in its service offering for companies and investors and help Kvika to use a strengthened financial position to improve customer services. The organization thus supports Kvika’s new strategy well. Following the changes there will be two revenue divisions operating in Kvika bank, Commercial banking on the one hand and Companies and Markets on the other[HG2] . In addition, three revenue divisions are operating through Kvika’s subsidiaries: TM, Kvika Asset Management and Kvika Securities in the UK.

During the year additional changes to the organization took place with the merger of the subsidiaries Aur and Negíró with Kvika bank. They are now operated as brands within the Commercial Banking division. Kvika bank also finalized the acquisition of the debt collection company Skilaráðgjöf and the preparation also began for operations of a new subsidiary of Kvika in payment processing called Straumur.

Kvika’s sustainability strategy

In early 2022 detailed strategic work in the field of sustainability took place with employees and managers from all areas of the Bank and its subsidiaries. The result was a new sustainability strategy for Kvika bank and the group. The strategy applies based on Kvika bank’s ownership policy for subsidiaries, which stipulates that sustainability and social issues are coordinated. The sustainability strategy was approved by the board of Kvika bank in November 2022 and it replaces the Corporate Social Responsibility (CSR) policy of the Bank.

During the strategy development emphasis was put on goal setting and project definition for the group’s revenue units within four focus areas that form the key themes of the strategy:

Kvika’s revenue units are at different stages in their sustainability work. The group’s new sustainability strategy will increase consistency and create a better overall vision for the issue on a group level. The strategy will also support and foster Kvika’s culture with sustainability as a guiding principle.

Along with the sustainability strategy six UN Sustainable Development Goals (SDGs), which fit Kvika’s priorities, were adopted.

Other ESG related policies were formulated during the year, including a policy on education and career development and a remote work policy. In addition, policies within sustainability were also updated, including: equality policy, health policy, human resources policy, remuneration policy and policy and response plan against bullying, harassment, and violence.

The group operates primarily in Iceland, where there are clear laws and legal frameworks for human rights and therefore it has not been deemed necessary to establish a human rights policy. Further information on policies can be found on Kvika’s website .

Work on implementing the sustainability strategy into operations will continue in the new year. Important steps in that work are defining measurable goals and metrics for the short and long term.

Sustainability organization and monitoring

At the beginning of the year the issue of sustainability and at the same time the position of project manager of sustainability, moved from Kvika’s operations and development to the CEO office where sustainability is managed at group level. Kvika Asset Management also added a new full-time position in the field of sustainability to carry out the numerous projects related to sustainability in fund and asset management.

Kvika puts great emphasis on ensuring that the implementation of sustainability into operations is coordinated between the different units. A good discussion on matters relating to sustainability took place at monthly meetings of Kvika’s committee on social responsibility and sustainability (hereafter “sustainability committee”). During 2022 the committee consisted of Kvika bank’s CEO, project manager for sustainability, director of finance, director of corporate loans, director of Lykill, director of human resources, director of operations at Kvika Securities, director of finance and operations at Kvika Asset Management and financial director of TM.

The committee supports the follow-up of Kvika’s sustainability strategy, which has been approved by the board, and monitors the development of sustainability on a consolidated basis. During the year Kvika Asset Management also established a sustainability council that monitors the development of the area from the perspective of asset and fund management. Kvika’s sustainability committee, the Bank’s and group’s executive board, the audit committee as well as the board of directors discuss sustainability issues and climate related risks every operating year.

Materiality Assessment 2022

Along with the construction of Kvika´s new sustainability strategy a materiality assessment was carried out on sustainability priorities in Kvika´s operations, considering ESG factors. Through the assessment and conversations with stakeholders, key priorities were identified that will benefit the implementation of the sustainability policy and the shaping of priorities, as well as in communication and disclosure

The assessment was carried out in accordance with the relevant GRI standard (GRI Standard 3 Material Topics1). The following steps were taken during the assessment:

1

Assessment of sustainability (ESG topics) associated with Kvika’s operations focusing on:

- Strategy, industry and business focus.

- Business partners, among others in which country they are located, as well the supply chain.

- Key stakeholder groups of Kvika

2

Subject categories that Kvika has or can influence were analysed with regards to the ESG topics which Kvika has or can have an impact on and that can be considered as the most important for Kvika’s operations and its key stakeholders. Kvika is not yet able to measure and evaluate the weight of each topic individually, and the assessment is therefore qualitative at this stage. This part of the assessment included the following steps:

- Preparation of an overview of the ESG topics that were potentially important. The overview considered the sustainability (ESG topics) associated with Kvika’s operations, see section 1 above, and it was weighed and evaluated at a meeting of Kvika’s sustainability committee. There was a total of 23 ESG topics included in the initial overview (six environmental, eight social and nine governance topics).

- A survey for Kvika’s stakeholders, which included 21 questions based on the overview of ESG topics and one open-ended question. The survey was sent to 1,588 stakeholders of Kvika divided into customers, employees, Kvika’s board of directors, the boards of directors of Kvika bank’s subsidiaries and shareholders.

The response rate was 24% overall. In terms of individual group response ratings, the highest response rating was among employees and members of the board of directors or 58%

3

Considering the topics identified through the materiality assessment Kvika’s sustainability committee confirmed that key topics for sustainability in the operations are:

Governance/operations

- Good governance

- Protection against money laundering, corruption, and bribery

- Information security and data privacy

- Development of digital services

Social topics

- Equality and well-being of employees

- Training and education of employees

Environmental topics

- Climate action in product development and innovation

- Climate action in the supply chain

Long-term thinking and innovation

Responsible investments at Kvika Asset Management

With a policy on responsible investments, Kvika Asset Management has made it a point to take environmental, social and governance (ESG) factors into account when making investment decisions. It applies to the entire investment process, from the selection and evaluation of investment options and periodically throughout the ownership period. In addition, ESG factors are considered in product development and innovations, which foster sustainability, and in simplifying and strengthening the infrastructures of financial services in line with Kvika’s new sustainability strategy.

The development of the sustainability focus of Kvika Asset Management can be traced back to 2008 when the first private equity fund, where ESG factors were integrated in the investment process, was established. Since 2017, further developments have taken place:

Focus in 2022

The key projects in 2022 that fall under the responsible investment policy of Kvika Asset Management and Kvika’s sustainability strategy is the preparation of ESG-focused funds that, among other things, contribute to a reduction in greenhouse gas emissions.

Work continued on the development of the ESG classification method for Kvika Asset Management domestic portfolio. Alongside the development of the methodology a new position in sustainability was created to further develop the area within Kvika Asset Management.

Furthermore, a sustainability council was established to serve as an employee forum for discussions on topics concerning sustainability and ESG related to product development. The sustainability council also handles monitoring and supports sustainability related processes of Kvika Asset Management.

Kvika Asset Management started work on calculating financed greenhouse gas emissions using the methodology of PCAF (Partnership for Carbon Accounting Financials) during the year. Within scope are asset portfolios of mutual funds and alternative investment funds for retail investors, as well as portfolios of institutional investors in asset management, as of the end of 2021. The portfolios include investments in listed securities, corporate bonds, and government bonds. The work continue in 2023.

ESG risk assessment and categorization of assets

The ESG risk assessment of Kvika Asset Management is based on an industry-focused risk assessment that the company uses to evaluate its domestic portfolio,based on how exposed the assets are to ESG risk factors and what actions need to be taken to limit sustainability related risks.

The risk assessment is also useful in discussions with investors and listed companies as well as in the implementation of ESG factors in the investment process of Kvika Asset Management. The methodology of the risk assessment has been documented and it is expected that the process will be fully implemented in the new year.

The ESG risk assessment covers Icelandic issuers of listed and unlisted securities except for municipalities, the government and fund operators. Currently the methodology does not apply to issuers of foreign securities, but the aim is to expand its scope.. The methodology is in constant development due to increased access to data, changes in regulations and continuous improvements.

Although companies are increasingly publishing ESG related information there are still challenges associated with obtaining and assessing the reliability of such information. It can be expected that data accessibility will improve and information will be standardized to a greater extent in response to the adoption of new sustainable-oriented legislation in Iceland.

Private equity and venture funds

Kvika Asset Management manages four private equity-and venture funds that invest in unlisted companies long-term but those are the funds Auður I, Edda, Freyja and Iðunn.

Through these funds the emphasis is placed on supporting managers of the companies invested in. This is done through various ways to improve their operations and performance. The companies are encouraged to be socially responsible, adhere to responsible business and good governance, promote diversity in management and consider environmental matters.

Sustainability and social responsibility are considered throughout the investment process of the impact funds, from the evaluation of investment options through the ownership period and in the preparation for the sale of the companies.

Prior to investment

Assessment of risks and opportunities

As part of the due diligence process, ESG factors are evaluated specifically as well as the attitude of co-owners and managers towards sustainability and socially responsible operations. The scope of the ESG due diligence differs between industries and the age of the companies.

Through the ownership period

Opportunities for value creation

Kvika Asset Management advocates that the companies set measurable ESG goals and that ESG factors that are insufficiently managed are improved.

At the exit stage

A stronger company at time of sale

The goal is that the companies are stronger than they were prior to investment and that they put increased emphasis on responsible and sustainable operations.

Key information on sustainability and corporate social responsibility across the portfolio is recorded and monitored. The private equity and venture funds of Kvika Asset Management regularly publish sustainability information for stakeholders in the form of an ESG report and through communication in the annual reports of specific funds.

Sustainability at TM

TM has over several years adhered to a policy on social responsibility and paid attention to sustainability in its operations. Goals were first set in this regard when Festa and the City of Reykjavík signed a statement on climate issues in 2015, and TM began measuring the carbon footprint of its operations. The company has regularly reported on its sustainability results and following the merger with Kvika bank in 2021 it was decided to conduct these measurements on a consolidated basis. All entities of the group are now in the same building and a significant part of TM operations has been outsourced to Kvika bank.

In 2022 TM applied for membership of he Principles for Sustainable Insurance (PSI), which is a sustainability framework of the United Nations for the insurance sector. The framework introduces key values that TM adheres to and relate to implementing sustainability in the operations and working with clients and suppliers on improvements in that area.

As an insurance company, TM employees are very aware of the developments that have taken place in regards to weather related events and the increased scope both in terms of their frequency and severity in recent years. This has amongst other things led to tougher conditions in reinsurance markets, notably for property insurances.

The importance of sustainability is increasing steadily, and TM’s management aims to ensure that sustainability is integrated into all the company´s activities. Only in this way can real progress be achieved for increased sustainability. TM’s employees participated in Kvika’s sustainability strategy development during the year and defined projects and goals to work towards under the key themes of the new sustainability strategy of Kvika.

TM has set a policy on responsible product and service offerings in line with Kvika’s priorities. Emphasis has been placed on the development of digital services in recent years so that customers can search for offers and buy insurance automatically. Examples of such responsible product offerings include insurance of electric bicycles and for cyber security. Supporting preventions in companies is an important part of TM’s work and attentive focus on that area has led to fewer accidents, especially in the fishing industry.

In TM’s sustainability work emphasis is placed on implementing ESG risk assessment for business partners that have 50 employees or more. The goal is to assess all customers that meet these criteria in the new year in parallel with the development of the group ESG risk assessment.

TM has made an effort to raise the awareness of its customers on sustainability issues, among other things by supporting the Article Circle. In addition, since 2010 the company has offered a yearly recognition for innovation through Svifalda (Gliding wave) award at the annual Seafood Conference. During the year 2022 the company SideWind received the award for developing wind turbines that are intended to reduce the amount of oil used by container ships.

Responsible investments

Investments are an important part of TM’s work and one of its two key revenue streams. Emphasis on responsible investments has increased but TM is one of the founding members of IcelandSIF, a sustainable investment forum. During the year an assessment of the ESG risk of TM’s investment portfolio was executed on around 60% of the portfolio, using the ESG risk assessment tool of Kvika Asset Management. This gives the company a better view of the sustainability risks of the investment portfolio.

During the year 2022 the company completed calculation of financed greenhouse gas emissions of its investment portfolio as of the end of 2021, but TM is the first Icelandic insurance company to issue information on the financed emissions of its investment portfolio. More information on the results of the financed emissions of TM’s investment portfolio can be found in the PCAF chapter of this report.

Responsible treatment of claim waste

The goals of the claims service for handling of claims waste relate to reducing the emission of greenhouse gases and minimizing negative environmental impacts through targeted actions. It is important that the disposal of damages and the handling of waste is in line with environmental and social goals of TM and the group.

TM has set goals to minimize the negative environmental impacts of damage waste and to avoid the emission of greenhouse gases (scope 3 in the Greenhouse Gas Protocol) due to damage waste. For decades TM has worked on reusing damaged goods, but it is planned to include special provisions on responsible disposal of damaged goods in contracts with the parties who, on behalf of the company, take care of repairs and disposal of waste after a damaged event.

In line with the emphases on a sustainable business environment in the new sustainability strategy of the group work started in 2022 on sending out risk assessments or surveys to all business partners for vehicle and real-estate damages. The goal of the survey is to get a better overview of the status of sustainability aspects at the partners that are involved in resolving vehicle and real-estate damage cases. In addition, the damage services are gradually working towards updating contracts with partners with clearer clauses and obligations concerning sustainability and environmental matters related to the treatment of damages. The goal is that all business partners will have received the survey at the end of 2023.

TM’s claims service also plan to explore further options concerning focus areas of sustainability, among other things through collaboration with parties in processing claims and through a more concrete safety and environmental training for customers during claims settlement. There are many synergies that create opportunities for information sharing and prevention. Further collaboration with the Icelandic authorities can also be explored where relevant, for example in large-scale damages, ship damages and fire damages, but in such cases, TM collaborates with several stakeholders.

The frequency of visits of customers to TM decreased substantially due to automation of claim processing, but emphasis has been put on automation at TM as well as on simplification of processes.

Automation and fintech

Automation and digital solutions can reduce environmental impacts and the emissions of greenhouse gases through less car traffic and paper consumption. At Kvika we realize that the development of new services in fintech and the automation of processes where processing is practically all digital is an important step in this journey.

Fintech involves the use of digital technology, information technology and the automation of processes and services to develop new solutions and approaches to financial services and to simplify and improve the financial services that are already in place. The use of new solutions and approaches aim to increase security and save time of the customer and employees as well as diminishing negative impacts on the environment.

Collaboration between Kvika and Creditinfo

Kvika and Creditinfo signed a co-operation agreement regarding the development of Vera, CreditInfo´s sustainability solution, during the year. During the development of the solution Kvika provided an expert opinion on several parts of Vera and how it is possible to use it in different areas within Kvika.

Sustainability reaches all parts of financial companies and is the basis of healthy operations. Vera is a custom designed database that is useful, amongst other, for financial companies as the solution provides relevant sustainability information that is useful for the work of risk management, asset management and/or in lending operations.

Kvika became a member of PCAF during the year and information, including from Vera, as well as specialist knowledge from Creditinfo, was used to calculate the financed emissions of greenhouse gases according to the PCAF methodology for Kvika’s commercial banking and corporate loans, as well as TM´s investments. That work was important for both parties of the partnership as Kvika now has a better understanding of the financed emissions from loans and investments and Creditinfo received a positive acknowledgement of the quality of Vera’s data. During the year work also began on calculating the financed emissions from Kvika Asset Management´s funds, and this work will continue in 2023.

Diverse digital opportunities

There has been a strong focus on the development of fintech solutions at Kvika bank since 2019 when Auður´s digital deposit accounts were launched. The specialized digital service of Auður and the effective use of infrastructure has enabled Kvika to offer higher interest rates, which benefits consumers. Other fintech solutions of Kvika bank are Aur and Netgíró which offer digital payment solutions and personal loans. A lot of work has been done on the digitalization of processes and services of Lykill, which in some cases are fully digital. In addition, TM has been a pioneer in digital solutions in the Icelandic insurance market, but the company offers a fully digital claim process.

The group continues to seize opportunities in fintech and increased digitalization of processes. Examples of projects that were launched during the year are the issuing of the Kvika securities app which gives the customers of Kvika bank and Kvika Asset Management a good overview of securities portfolios in a simple way. The ordering system for funds of Kvika Asset Management and the services for customers in asset management were also increasingly automated for the benefit of customers and employees. In addition, TM worked on a solution called Bót, which enables customers, employees, and contractors to monitor and electronically register the progress of claims.

Data hosting

The positive environmental impacts of digitalization are clear when considering the reduction of greenhouse gas emissions linked to less car traffic and the reduced use of paper resulting from the new technology. However, the increased need for energy associated with digitalization must also be considered as technological solutions are energy intensive. The environmental impact associated with data hosting providers is one of the aspects that Kvika considers when selecting partners for hosting data and systems. All data centers that Kvika works with in Iceland mostly use renewable energy for their operations. Furthermore, Kvika uses the hosting services of Amazon and Microsoft in Europe, both of which use solar and wind energy as sources of energy and have set goals for carbon neutrality in the near future.

Society

Our people

Our employees are very important to us because their knowledge and skills have brought Kvika to where the company is today. During the year the number of employees in the group increased slightly but at the end of 2022 there were 386 employees in the group, including the UK operations. The operations of the group in Iceland were combined in one location and it has been a successful integration. A systematic effort was made during the year to bring employees together so that they get to know each other and the operations of the different entities of the group, for example through presentations in the dining hall, events of different kinds and organized visits between divisions.

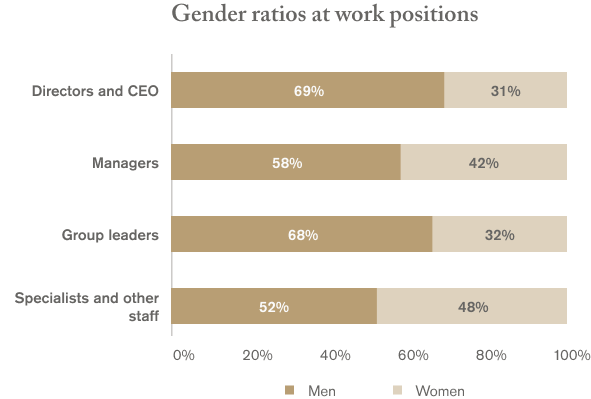

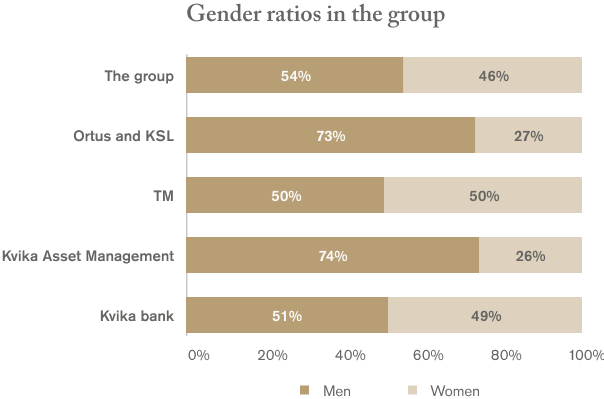

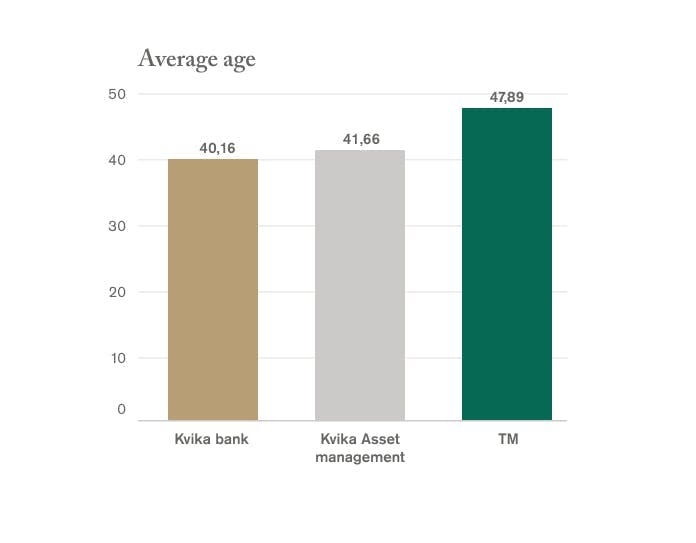

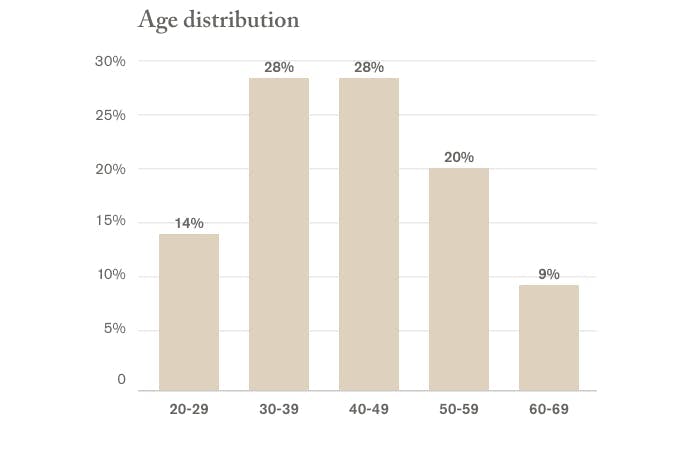

Below is an overview of Kvika’s employees, divided by the largest companies, including in the UK, with the ratios of age, gender, and position.

Employee turnover of the group in 2022 was 9,3% which is a slightly lower percentage than the previous year (11,5%).

Wellbeing and training of employees

We put emphasis on creating a positive and safe working environment where everyone has the same opportunities. We have developed human resource-, equality- and health policies which lay the foundation of an action plan which is followed and revised on an annual basis. Kvika bank and TM have received a certification of equal pay in accordance with the standard ÍST 85: 2012. Kvika Asset Management also underwent an audit of its equal pay system at the end of 2022 and a formal equal pay certification is expected in the first quarter of the year 2023.

Good health is a prerequisite for our success at work as in other parts of life. To foster better health and wellbeing of our employees we offer gym and transportation grants and offer employees essential vaccines and health checks at the workplace on an annual basis. Health weeks have also been organized with educational presentations and various kinds of exercise and motivation for employees to think about their health. In addition, healthy and nutritious food is on offer for breakfast and lunch every day and healthy snacks are available for all employees.

Several courses and other training opportunities are available to employees, both elective as well as mandatory subjects, which increases their knowledge of the operations and further enhances their skills. In most cases the sharing of the content takes place digitally through the education system Eloomi, which also tracks the employees’ training activities and their duration. In addition, courses and shorter talks are held in our headquarters. On average each employee of Kvika attended 21 digital courses in 2022.

Flexibility

The arrangements that were made at the start of the COVID-19 pandemic continued in the first quarter of 2022 in line with the instructions of authorities and circumstances at each time. A special committee followed the developments and ensured the safety of employees with appropriate arrangements.

Most employees continued working remotely throughout the pandemic and online meeting platforms were used for communications and meetings. Remote working arrangements will be kept up for those who want that arrangement in line with the remote work policy which was implemented during the year. The policy fosters increased flexibility for employees where it is possible and at the same time it diminishes environmental pollution with fewer car trips of employees to and from work.

Workplace analysis

To gain the best overview of how employees are feeling and their views of the workplace and management a workplace analysis is performed on an annual basis, focusing amongst other things on work engagement, work satisfaction, stress, views on equality and work life balance. Other questions include work related bullying, harassment, and violence. Following such surveys results are analyzed and an appropriate action plan is developed.

The survey for 2022 revealed that work satisfaction is high, an average it was 4,38 out of 5 and employee engagement was 4,09 on average. The survey also revealed that Kvika’s employees experience a good work atmosphere and collaboration and that they are proud of working for the company. A workplace analysis also provides information on opportunities for improvements and offers a greater understanding on how we can build a supporting and encouraging work environment. In addition, the analysis gives an insight into the potential differences between the views or experiences of employees in different divisions.

The results of the analysis indicated that personal feedback from managers could be enhanced. This has, among other things, been followed up with an encouragement to conduct more regular employee interviews and training managers on providing feedback.

Supply chain

Kvika hefur innleitt siðareglur fyrir birgja og framkvæmir birgjamat á mikilvægustu birgjum sínum en við skilgreiningu á þeim hefur verið horft til sjónarmiða í útvistunarstefnu Kviku þar sem mikilvægir útvistunaraðilar eru skilgreindir í samræmi við lög og reglur þar að lútandi fyrir eftirlitsskylda aðila.

Siðareglurnar snúa að því að setja viðmið um að birgjar bankans taki mið af UFS-þáttum í starfsemi sinni. Kröfur eru settar á þá birgja sem skilgreindir eru sem mikilvægir. Þeim er ætlað að staðfesta siðareglurnar og gera grein fyrir því hvernig unnið er með sjálfbærni og UFS-þætti í starfseminni en spurt er út í þá þætti í birgjamati. Í lok árs 2022 höfðu sjö af níu birgjum sem skilgreindir eru sem mikilvægir staðfest reglurnar.

Miðað er við að sem flestir aðrir birgjar fái siðareglurnar sendar en fyrir þá er það valkvætt hvort þeir staðfesta þær eða ekki. Siðareglurnar eru einnig aðgengilegar á vef Kviku. Rekstrardeild Kviku hefur eftirlit með þessum málaflokki.

Gera má ráð fyrir að á árinu 2023 verði ferlið yfirfarið og bætt til samræmis við áherslur í nýrri sjálfbærnistefnu samstæðunnar sem leggur áherslu á að Kvika sem fjármálafyrirtæki hafi jákvæð áhrif á viðskiptaumhverfi sitt með auknum kröfum um UFS hjá samstarfsaðilum, þar á meðal við val á birgjum.

Collaboration and participation in the community

One of the guiding lights of Kvika’s strategy is that Kvika participates in a responsible way in the community with an emphasis on long term thinking. We focus, among other things, on having a positive impact on the development and functioning of financial markets and we support innovation.

Positive impacts on financial markets

Kvika puts emphasis on offering a variety of investment options and actively participates in discussions on the development of financial markets, for example through IcelandSIF but Kvika is one of the founding members of the organization, as well as through Festa – centre for sustainability.

One of the strategic goals of Kvika is to increase competition in financial markets. Considering that goal, it has been a pleasure to observe the development of the market of deposit accounts following the establishment of Auður’s deposit accounts in 2019. The accounts offer high interest rates, and it has led to a positive impact on competition and thereby on the interest revenues for households. With fully online services and a minimal overhead Auður manages to keep costs at minimum and offer customers the highest possible interest rates, with and without a retention period.

SoGreen

Kvika is starting a collaboration with SoGreen which is an Icelandic startup that produces carbon credits. Kvika first supported SoGreen in 2022 through Kvika’s charity fund FumkvöðlaAuður.

The carbon credits will be produced by ensuring education for girls in low-income countries. Research has shown that education of girls is one of the most impactful solutions for combating climate change.2 The first project of SoGreen will start in Zambia at the beginning of 2023, it will ensure five years of primary school education for up to 200 girls and will run until the end of 2027. For each avoided ton of CO2-equivalent SoGreen produces one carbon credit. The project is expected to produce around 14,720 carbon credits and avoid around 14,720 tons of CO2-equivalent.

The carbon credits are sold in advance to finance the project and Kvika will be one of the first Icelandic companies to buy credits. SoGreen is in the process of getting certification for the credits in accordance with the technical criteria of the standard ÍST TS 92-2022 issued by Icelandic Standards last year.

Grants

Kvika offers grants annually to various projects that have a positive impact on the community and a special emphasis has been put on education and the development of financial markets. In 2022 a new policy for grants was developed for Kvika to ensure a coordinated process for grants and to ensure that grants are given in line with the goals of Kvika’s sustainability strategy. The new policy for grants considers the UN Sustainable Development Goals in line with the sustainability strategy.

Among goals of the strategy is to encourage diversity of grant receivers and to avoid consolidation of grants to specific individuals and companies. The policy puts emphasis on gender equality, but Kvika supports women specifically through allocations from the charity fund FrumkvöðlaAuður.

FrumkvöðlaAuður

FrumkvöðlaAuður is a non-profit organization founded by Auður Capital in 2009. Originally the organization was called AlheimsAuður and it had the goal of being a charity fund with the key strategy of encouraging women to take action and innovate, notably in developing countries. In recent years the fund has also invested locally with an emphasis on women’s entrepreneurship. In addition to SoGreen the following projects received grants in 2022:

- Snerpa Power empowers power intensive electricity users by automating and digitalizing the planning of industrial load and optimizing offers to the market through system services.

- Orb Vision is developing a software solution which measures the carbon capture of forests and facilitates the production and trading of certified carbon credits and thereby encouraging the planting of forests.

Kvika also has an incentive fund for students in vocational and teaching studies with the goal of increasing the discussion and awareness of the importance of vocational and teaching studies and their importance for the Icelandic economy.

Kvika has been the key partner of UNICEF in Iceland in banking services since 2011 and is also a special supporter of Global Parents. Other grants in 2022 include the following projects:

- The January conference of Festa

- Educational fund of the Mothers Support Committee

- ABC Children’s Aid

- Icelandic Management Awards of Stjórnvísir

- Centre for Social and Economic Research

The total amount of grants at the group during the year was 86.965.000 ISK

Environmental and climate issues

Kvika supports the goal of Icelandic authorities to reach carbon neutrality by 2040. One of the guiding lights of Kvika’s strategy is to be a responsible participant in society and the group has set itself the goal of contributing to the reduction of carbon emissions and having a real and measurable impact on Iceland’s carbon footprint and climate issues in general.

Kvika’s sustainability strategy outlines further the group´s priorities. It states amongst other things that Kvika considers sustainability in product development and innovation and focuses on innovations that help reduce carbon footprint and strengthen the infrastructure of financial services. It also notes that the group strives to have a positive impact on its business environment with increased demands for emphasis on the ESG factors by customers and business partners. Kvika emphasizes reducing the negative environmental impacts that the operations might have, and Kvika’s environmental and employee transportation policy outlines the relevant factors in that context.

Efforts have been made to track the carbon footprint of the operations since 2020 for Kvika bank and Kvika Asset Management, but TM started such measurements in 2015. The environmental impacts of Kvika´s own operations is managed through a digital environmental management system and the environmental accounting is combined for Kvika’s Icelandic operations. During the year Kvika finalized measuring financed greenhouse gas emissions according to PCAF for certain asset classes.

Kvika has at this stage neither set measurable targets on reduction of greenhouse gases nor science-based targets but aims to establish such targets parallel to implementing the sustainability strategy into operations in the new year, and increased understanding of the environmental impacts of the operations.

Environmental indicators

The calculated total emissions of the group in scope 1, 2 and 3 have increased looking back three years in parallel with increased activities following the acquisition by Kvika bank of TM and Lykill in 2021, when new operational units were added to the group’s environmental accounting.

In 2021, Kvika also started measuring emissions due to waste and employee transportation. In May 2022, all operations were combined in the same location. The same year, for the first time, Kvika completed the measurement of the group’s financed emissions in specific asset classes, based on the end of 2021, according to the PCAF methodology, as further outlined in the PCAF section of this report.

The environmental indicators for the years 2020-2022 are influenced by the impact of the COVID-19 pandemic and the actions taken in the operation in line with recommendations of the authorities. Due to fewer flights and less employee driving to and from the workplace, there was a reduction in emissions until February 2022, when the authorities lifted quarantine measures.

Various measures were taken during the year to promote the minimization of negative environmental impacts. Education for employees on sustainability was increased. Furthermore, a remote work policy was implemented, which is amongst other things intended to promote a lower environmental impact with fewer trips of employees to and from the workplace.

Kvika also encourages employees to continue to increase the use of online meetings and thus reduce the number of trips by car and to make use of environmentally friendly transportation by offering grants through a collaboration with the public bus company Strætó.

A positive trend can be seen between years in energy efficiency, energy consumption per employee has decreased by around 16% in the period 2020-2022. In addition, the total amount of waste has decreased in 2022 compared to 2021. The emission intensity remained similar between 2022 and 2021. Further information about key environmental indicators can be found in the following tables as well as in the index table at the end of this report.

| Greenhouse gas emissions | 2020 | 2021 | 2022 | ESG Indicators |

|---|---|---|---|---|

Scope 1 (CO2-equivalent) | 11,1 | 28,5 | 33,2 | E1 (1) |

Scope 2 (CO2-equivalent) | 11,0 | 23,7 | 24,5 | E1 (2) |

Scope 3 (CO2-equivalent) | 3,4 | 160,1 | 196,1 | E1 (3) |

Emission intensity of employees (kg CO2-equivalent / FTE) | 187,6 | 671,5 | 706,8 | E2 |

| Energy usage | 2020 | 2021 | 2022 | ESG Indicators |

|---|---|---|---|---|

Total amount of energy directly consumed (kWh) | 43.792 | 115.115 | 133.197 | E3 (1) |

Total amount of energy indirectly consumed (kWh) | 1.223.090 | 2.566.030 | 2.686.765 | E3 (2) |

Total direct energy usage per FTE (kWh/FTE) | 9.315 | 8.479,3 | 7.855 | E4 |

| Energy usage by generation type | 2020 | 2021 | 2022 | ESG Indicators |

|---|---|---|---|---|

Fossil fuels (%) | 3,5% | 4,3% | 4,7% | E5 |

Renewable energy (%) | 96,5% | 95,7% | 95,3% | E5 |

| Waste | 2020 | 2021 | 2022 | ESG Indicators |

|---|---|---|---|---|

Total amount of waste (kg) | - | 29.253 | 23.471 | |

Share of sorted waste (%) | - | 72,9% | 73,1% | |

Share of recycled waste (%) | - | 72,9% | 75,1% |

| Water usage | 2020 | 2021 | 2022 | ESG Indicators |

|---|---|---|---|---|

Total amount of water used (m3) | 35.146 | 54.111 | 59.729 | E6 (1) |

Cold water (m3) | 17.405 | 20.025 | 21.792 | |

Hot water (m3) | 17.741 | 34.085 | 37.937 |

Carbon offsetting 2022

In line with Kvika’s strategic goal, efforts are made to reduce greenhouse gas emissions from in the operations. In addition, Kvika has carbon offset measured emissions that took place in 2022, but the total amount of greenhouse gas emissions in scope 1, 2 and 3 in 2022 amounted to 253,8 tons of CO2-equivalent.

To offset the carbon emissions Kvika purchased 255 tons of CO2-equivalent of certified carbon credits from the American company Aspiration, which has been working for years on climate projects, which deliver high quality carbon credits and tangible positive environmental and social impacts, where the projects are located.

The carbon credits Kvika purchased will be used to finance three projects, which are all categorized as REDD+ projects. They concern actions to combat climate change with an emphasis on sustainable land use and efforts to combat forest degradation in developing countries.

A description of the three projects follows but they support the UN Sustainable Development Goals, including goal 4 on quality education, goal 5 on gender equality, goal 13 on climate action and goal 17 on partnerships for the goals, which are among the goals that Kvika supports. The projects are certified according to the Verified Carbon and Community & Biodiversity standards.

Mai Ndombe (Democratic Republic of Congo)

The project protects around 250,000 hectares of rainforest land against illegal forestry and unsustainable agriculture. The forest is the habitat of chimpanzees, bonobos, forest elephants and wetlands which are amongst the most important wetlands on the planet. The area is inhabited by around 180,000 people. The project is the first of its kind in the Congo basin and it is expected that in total the project will avoid the emissions of 175 million tons of CO2-equivalent over 30 years. Among the positive impacts of the project is support for education and employment in the area, the protection of biodiversity and an increased level of health services.

Cordillera Azul (Peru)

The project concerns the protection of 1,3 million hectares of national park in the middle of Peru. Among benefits of the project are the mitigation of deforestation and collaboration with communities and other stakeholders on the use and management of land with the goal of nature conservation. The area hosts 6,000 types of plants and over 800 mammals, fish, and bird species, among which 39 endangered species. The project has a positive impact on 35 surrounding communities and supports amongst other the schooling of around 5,000 students. It also supports job creation, but 688 jobs have been created by the project among which 39% are occupied by women.

Katingan (Indonesia)

The project protects critical wetlands in Indonesia which are the habitat of endangered animals, but the wetlands also bind an enormous amount of carbon. The project avoids the emissions of around 500 million tons of CO2-equivalent. The project creates jobs for over 500 people. Emphasis is on training the public in land and forest conservation but 34 villagers directly participate in decision making related to the project.

PCAF (Partnership for Carbon Accounting Financials)

Kvika became a member of PCAF in 2022. The same year Kvika started a collaboration with Creditinfo on calculating the financed or indirect greenhouse gas emissions (scope 3) of loans and investments for Kvika’s commercial banking and corporate loans, as well as of the investments of TM according to the PCAF methodology. The results take account of the status of emissions at the end of the year 2021 and considers listed shares and corporate bonds, government bonds, corporate loans and unlisted shares, car loans and mortgages. Work also began on calculating the financed emissions of the asset portfolios of Kvika Asset Management and that work will continue in 2023.

Financed emissions

Greenhouse gas emissions from business operations are classified as direct and indirect. The methodology for identifying direct and indirect emissions involves the categorization of scope 1, 2 and 3. Scope 1 concerns the direct emissions that the company is responsible for, such as from the vehicle fuel consumption. Scope 2 concerns the indirect emissions associated with the production of electricity or heat, such as the operation of a building. Scope 3 is indirect emissions due to the production of inputs received by the company or due to the use of sold products. Investments and loans fall under scope 3 and the PCAF methodology outlines financial companies’ approach to how financed emissions are calculated from loans and/or investments.

The core of the PCAF methodology is the so-called attribution factor which indicates how much of the emissions of a company in an asset portfolio is calculated as indirect or financed emission of a financial institution, but the attribution factor calculation differs between asset classes. When companies do not publish their greenhouse gas emissions from their operations it is possible to estimate the emissions in which case data that is close to the operations of the given companies is used. In these cases, Kvika relied on data from Vera, Creditinfo´s sustainability solution.

Key results

Commercial banking and corporate loans

The results indicate that the emissions are highest from car loans, second highest from corporate loans and then mortgages. Emissions associated with car loans are 0,42 tons of CO2-equivalent for each million loaned. Emissions associated with corporate loans of Kvika bank for each million loaned is 0,24 tons of CO2-equivalent. The highest emission intensity (tCO2-eq./ISKm) in the portfolio are associated with loans to companies involved with water supply, treatment of sewage, waste management and decontamination. Emissions due to mortgages is insignificant compared to other loans of Kvika, but the emissions are around 2 kg of CO2-equivalent (0,002 tCO2-eq.) for each million loaned. Real estate loans are therefore on average the most environmentally friendly loans offered by the group.

TM

The emissions of TM’s investment portfolio are 12,25 kilotons of CO2-equivalent which is mostly due to investments in government bonds or 0,46 tons of CO2-equivalent for each million invested without land use (LULUCF3). Investments in real estate are TM´scleanest investments but their emission intensity is 0,001 tCO2-eq./ISKm. The total emission intensity of the investment portfolio of TM is 0,39 tCO2-eq./ISKm.

Further information on financed emissions of the group will be outlined in a report that will be published in 2023.

Green financing framework

Kvika‘s green financing framework outlines how funds are allocated to green projects. Green projects include lending related to energy transition for transportation, environmentally certified buildings, and renewable energy.

The green financing framework builds on international principles (Green Bonds Principles) that were issued by the International Capital Market Association – ICMA.

The principles have four core components:

- Use of Proceeds.

- Process for Projects Evaluation and Selection.

- Management of Proceeds.

- Reporting

The framework received a positive second party opinion from the international analytics and rating firm Sustainalytics confirming that the framework is credible and that it has the potential to be impactful. The framework will integrate new requirements of the European Union no. 2020/852 (EU taxonomy for sustainable activities) as relevant once the regulation takes effect in Iceland.

Kvika’s new sustainability strategy and in the Bank’s policy on responsible lending and investment, which is annexed to its credit rules, put forward focus areas in green and sustainable lending. Following Kvika’s work on sustainability strategy development during the year, education was increased for business managers about responsible and green lending. One of the projects emerging from the strategy development work was to set economical internal incentives for the Bank’s business, which include more favourable internal pricing for green projects. In this way Kvika wants to encourage the revenue divisions to seek more green projects and increase the share of green loans, which at the same time supports green investments. During the year the quarterly confirmation of green assets, as stipulated in the green financing framework, moved from the sustainability committee of the Bank to the credit committee.

Allocation and impact report 2022

As outlined in the green financing framework of Kvika bank, which follows the international Green Bond Principles, the Bank reports on its green commitments on an annual basis. This is the second time that such an overview is issued as part of Kvika’s sustainability report.

At the end of 2022 the total value of green commitments was ISK 6,392,865,162, which can mostly be allocated to the issuing of Kvika’s green bonds at the end of 2021 and 2022, but also to Auður’s green deposit accounts.

All green liabilities have been allocated within the asset class “clean transportation” to eco-friendly car loans by Lykill. In that way Kvika creates an incentive to reduce greenhouse gas emissions, but the results of calculated financed emissions of the Bank’s loan portfolio indicate that car loans are the loans that emit the most.

Part of Lykill´s asset portfolio are green car loans, but in 2021 Lykill started offering special loan terms for green loans. This concerns electric- and hydrogen cars that run on 100% renewable energy and plug-in hybrid vehicles with a CO2 emissions factor under 50 gr CO2/km in accordance with international pollution standards. In 2022 it was decided to increase the discount offered to customers on new loans due to the purchase of 100% electric vehicles and hydrogen vehicles, and a large increase in the financing of green vehicles at Lykill can be seen between years or about 60% increase. There has been an increase in the sale of environmentally friendly vehicles in the past year, and Lykill has offered competitive terms on the market.

The growth of the use of electric vehicles in Iceland

For Icelandic society the advantages of green electricity are various and include among other things environmental protection, public health, economic benefits, and energy security. The ongoing energy transition that is taking place with the electrification of private cars has advanced well in the recent year. The country is in second place after Norway in the number of electric cars on the roads (4,6% according to the Icelandic Automobile Association) and governmental incentives have played an important role there. Tax incentives, to level the playing field against cars that run on fossil fuels, have facilitated the transition over to electric cars. Ahead is the energy transition of larger vehicles but the first electric trucks are already driving on the country’s roads. It can be expected that the number of such vehicles as well as electronic buses will increase rapidly in the coming years. Kvika bank will continue its contribution to supporting this positive development which is an important part in achieving the carbon neutrality of Iceland by 2040.

The financing of green vehicles that are included in the green financing framework include passenger cars, vans, trucks, motorcycles, and heavy commercial vehicles. The largest category is passenger cars.

| Type of vehicle | Number of vehicles | Amount in ISKm |

|---|---|---|

Passenger car | 2.419 | 9.097 |

Other vehicles | 109 | 204 |

Total | 2.528 | 9.301 |

Assessing the impact of financing green projects or assets, we mean the carbon footprint that has been prevented by their financing (in tons of CO2-equivalent). The estimated impact (or avoided emissions) from the financing of green vehicles during the year 2022 can be found below.

| 2022 | Total number | Estimated avoided emissions in tCO2-eq. |

|---|---|---|

Green vehicles | 2.528 | 2.956 |

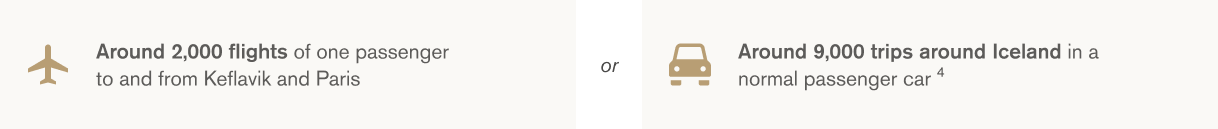

The methodology for the calculation of the impact metrics considers international guidance and standards. To put the estimated avoided emissions in context, it is the equivalent of the emissions of:

Governance and ethics

Kvika conducts its governance in accordance with the guidelines for corporate governance issued in 2004 by the Icelandic Chamber of Commerce, Nasdaq Iceland and the Confederation of Icelandic Enterprise. They were last updated in February 2021 (6th edition) and took effect in July 2021. Kvika also adheres to the Guidance of the European Banking Authority (EBA) on internal governance of financial institutions (EBA/GL/202/05).

Information on the key aspects concerning governance can be found in the annual governance statement which is published in the annual account and on the website of Kvika bank. Kvika’s operations take place partially through subsidiaries but Kvika bank as the parent company is responsible for the group’s governance. The governance statement includes information on key aspects of internal control, risk management and accounting of the parent company.

Information on the board of director of Kvika bank can be found on the website of the bank.

Code of conduct for employees

The code of conduct of Kvika bank was updated in the beginning of the year 2022 and approved by the Bank’s board of directors.

The purpose of the code of conduct is to outline the ethical values that employees adhere to in their work for Kvika bank. The code sets ground rules for good business conduct and employees should use them for guidance during their interactions with customers and other parties in relation with their work on behalf of the Bank.

The goal of the code of conduct is to ensure the protection and interest of Kvika’s customers as well as others that have an interest associated with their communication with and their work on behalf of the Bank. The rules also support a good working environment and good governance. In addition, the code of conduct helps reduce risk, notably operational and reputational risk, but the code of conduct is one of the key defense mechanisms of the Bank against corruption and bribes.

Prevention of money-laundering, terrorist financing, corruption and bribery

Kvika bank has established rules, appropriate processes, and monitoring for measures against money-laundering and terrorist financing in accordance with relevant laws and regulations. Kvika bank conducts a comprehensive risk assessment on its operations and cate gorizes the risk of its business relationships according to the risk assessment. During regular monitoring of transactions Kvika uses the digital solution Lucinity.

Kvika has established rules on the actions against conflicts of interest that among other things aim to increase the credibility and protect the reputation of the Bank. The rules are intended to avoid or address conflicts of interest that can occur in connection to the provision of investment- or additional services. In addition, the following rules and policies have been established:

In addition, the following rules and policies have been established:

- Rules on presents, rewards, and incentive payments.

- Policy on reputation risk and behavioral risk.

- Rules on separation of work areas.

- Rules on the personal transactions of employees.

The above rules and policies are established on a consolidated basis and lay the foundation, in addition to the code of conduct, to Kvika’s measures against corruption and bribery.

Information security

Kvika has a certified information security management system in accordance with the ISO/IEC 27001 standard. However, Kvika Securities in the UK is still outside the scope of the of the management system.

The information security management system concerns how companies set up organized work practices and processes for handling sensitive information and systems. Kvika’s goal for implementing the management system is to ensure the responsible treatment of the information that customers trust Kvika with as well as protecting sensitive information concerning the operations of Kvika from unauthorized parties.

The system supports the implementation of Kvika‘s information security policy but its goals are amongst other to:

- Limit operational risk.

- Limit operational risk.

- Increase the level of service of information systems.

- Increase the reliability and operational security of information systems.

Kvika conducts a systematic risk assessment to identify whether further arrangements are needed concerning specific data or information systems. Kvika’s information security policy is revised at least every two years.

Index table

About the company

| Lýsing | Chapter/material | Page | GRI indicators for reference |

|---|---|---|---|

Name of organization | Kvika banki hf. | - | GRI 2-1 (a) |

Nature of ownership and legal form | Publicly listed company | - | GRI 2-1 (b) |

Location of headquarters | Katrínartún 2, 105 Reykjavík | - | GRI 2-1 (c) |

Countries of operation | Iceland and the UK | - | GRI 2-1 (d) |

Entities included in the report | Chapter: About the report | 3 | GRI 2-2 |

Reporting period for sustainability reporting and frequency | 1 January – 31 December 2022, yearly | - | GRI 2-3 (a) |

Reporting period for financial reporting | 1 January – 31 December 2022 | - | GRI 2-3 (b) |

Publication date of report | 15 February 2023 | - | GRI 2-3 (c) |

Contact point for questions regarding the report | Anna Þórdís Rafnsdóttir, kvika@kvika.is, tel. +354 540 3200 | - | GRI 2-3 (d) |

Information on employees | Chapter: Our people | 17 | GRI 2-7 GRI 2-8 |